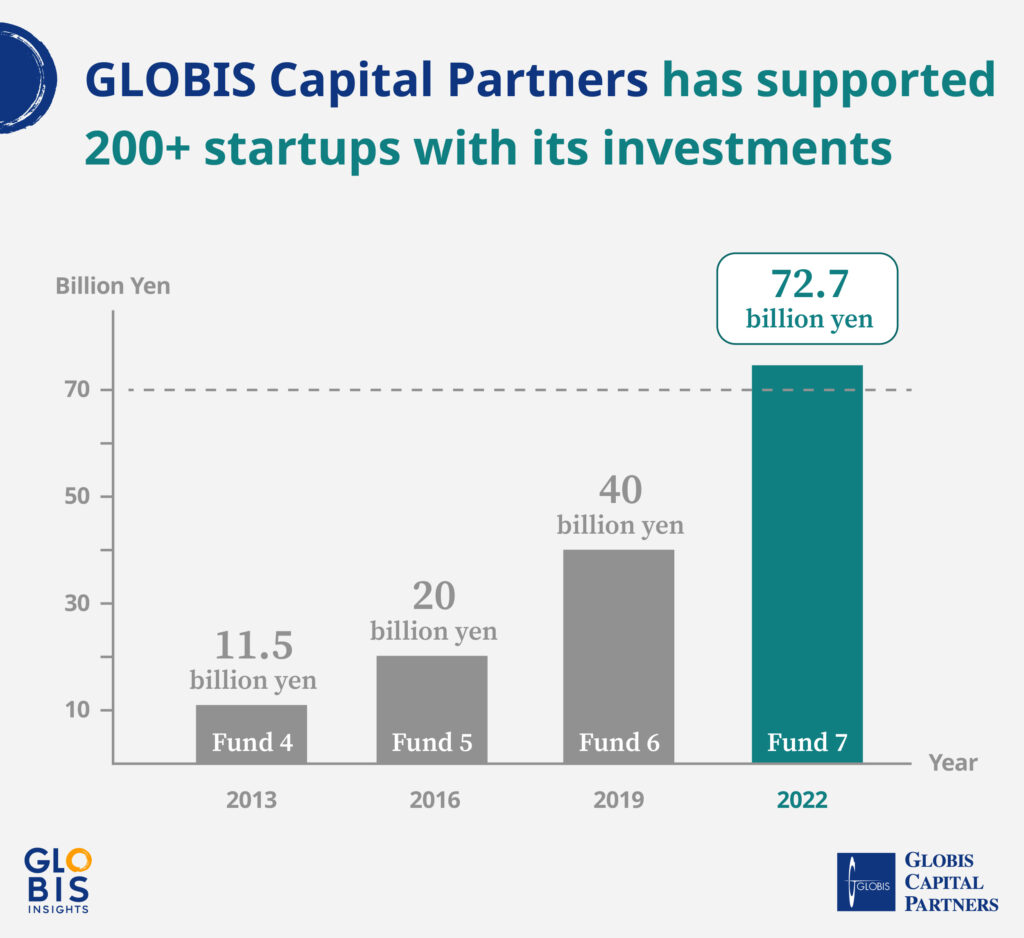

As of March 31st, 2023, GLOBIS Capital Partners has completed fundraising a total of 72.7 billion yen for its 7th fund. GLOBIS Chikenroku’s Yoshika Yoshimine interviewed two new general partners, Satoshi Fukushima and Emre Hidekazu Yuasa, about the background to the establishment of the 7th fund and its vision for the future.

Continuing to Attract Outstanding Talent into Startups

Why was the 7th fund established in 2022?

Fukushima: Emre and I have been in this business for nine years. And we’ve seen a change in the quality of talent coming into startups in this time. In the past, startups were not attracting top talent, but now we see more and more outstanding people coming into the startup space. As a result, we see startups beginning to raise a lot of money, and because of that, more startups are taking on challenges that were previously impossible.

The government is also starting to see the startup space as a fresh source of competitiveness for Japan. Considering this shift in perception, we want to support startups that look to take on challenges at a global scale, while continuing to support traditional startups. That is the goal of the 7th fund.

As a result, the size of the 7th fund is 72.7 billion yen, which is significantly larger than the 6th fund’s 40 billion yen. This will allow us to invest more in each company.

Yuasa: Adding to that, the 4th, 11.5 billion yen fund, was established back in 2013, and the 5th 20 billion yen fund in 2016, and the 6th fund in 2019. We have been raising funds every 3 years. The basic policy of fundraising every 3 years remains the same, but we expect to see even more ambitious startups in the future, so we’re preparing to support them by establishing our largest fund ever.

Besides entrepreneurs, there’s also lots of talent from large companies coming into the startup space looking to replicate the success of big business. Is this a trend across the entire industry, or more of an individual case basis?

Fukushima: I think it’s an industry-wide trend. More people are shifting their careers to take on bigger challenges that provide new value to society and improve the entire world.

Yuasa: The ambition and scale of startups are also expanding.

For example, Mercari was valued at 400 billion yen when it went public, and then it continued to grow to 700 billion yen, and at one point it was valued at over one trillion yen. And Mercari isn’t confined to Japan—they’re in the United States as well. When ambitious entrepreneurs see a massive company like Mercari come out of Japan, it inspires them to want to do the same. I think this will continue to raise the ceiling for startups.

Investing in Unicorn Startups and Beyond

What kind of startups do you want to invest in with the 7th fund?

Yuasa: We considered our 6th fund to be our “unicorn fund,” but the 7th fund is our “beyond unicorn” fund. This means we’re targeting two specific areas:

- Industries with a large domestic market within Japan, like healthcare, construction, manufacturing, and real estate, etc.

- Domestic startups that have the potential to go global and leverage Japan’s strengths in foreign markets. The latter would be areas that are highly regarded overseas, like Japanese entertainment. We want to strongly support these areas.

GLOBIS Capital Partners has always invested in large markets. What’s the difference with fund 7?

Fukushima: In the past, startups tended to focus on solving specific problems within larger industries. For example, with large amounts of money flowing to venture capital firms, it became possible for them to develop programs and utilize AI to improve the efficiency of manufacturing facilities, but it wasn’t enough money to build the factories themselves.

That’s why hardware companies that utilized robotics, and the software companies that created the AI for these robotics companies, were launched individually.

But with the increase of talent and capital raised, these companies may be able to come together and create new solutions. That is the difference.

With the 7th fund, we’ll be investing in businesses that have a strong, scalable business model.

Multiple Opportunities for Global Expansion

Is it the same for the global market?

Yuasa: Recently, we’ve seen startups that have raised tens of billions of yen here in Japan. If such large-scale fundraising becomes easier, entrepreneurs will want to access the global market from the start, and there will be cases where businesses are started by working backward from there.

Fukushima: In the case of AI Medical Service, which I’m on the board of, there is a lot of demand overseas for specific services and technologies. In the past, even if challenges breaking into the North American, European, and Asian markets would have come up simultaneously, we would’ve stopped and said: “That’s crazy! How are you going to fund it?”

But now, we can fully support such cases. That is why we are making the fund bigger and increasing the team.

Exploring the Change in GCP’s Role as Funds Increase

How will GCP’s response change in this situation?

Yuasa: Originally, our strength as a VC is to prove full-scale hands-on support.

Hands-on support means not only providing funding to our portfolio companies, but also joining the boards and working closely with the management team to help them overcome challenges as they arise. In the process, we will actively expand our network to find people, potential customers, and business partners.

But as our portfolio companies become more diverse and what we need to do become more complex and ambitious, we need to change as well. Three years ago, we established a special support team for our portfolio companies called “GCPX,” which provides support for designing organizations including executive hiring and middle management hiring.

More recently we’ve been able to help with hiring engineers, as well. And I think we can do more.

In the future, we want to increase our support for startups that are aiming for global expansion. For example, in April 2023, GCP established a San Francisco office. This office is operated jointly with GLOBIS USA and is in the same building as SmartNews, one of GCP’s portfolio companies. We hope this office will allow startups that are entering the US market to receive advice from SmartNews, who are a pioneer in the US market, and to promote information exchange between them.