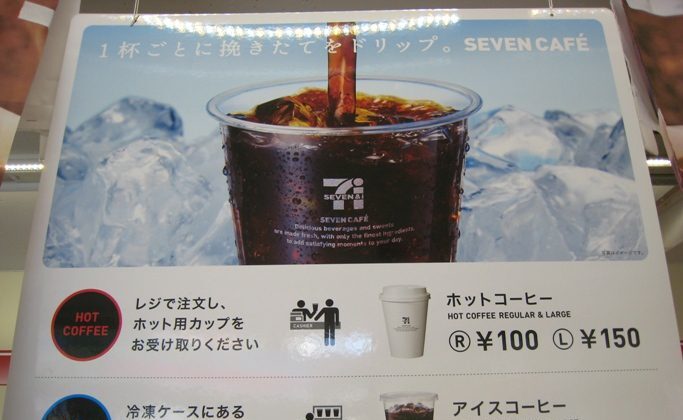

I love coffee and my daily routine usually starts off with a nice cup of freshly brewed coffee. You can imagine my delight when my neighbourhood Seven-Eleven convenience store introduced self-service coffee machines which serves high-quality drip brews in 45 seconds, with the basic cup going for ¥100. The company plans to introduce self-service coffee machines in around 15,000 stores in Japan by the end of August 2013, with an annual sales estimate of 330 million cups which is comparable to Mac Donald’s sales figures for coffee. Lawson, Circle K Sunkus, Mini Stop, and Family Mart have also introduced their own versions of self-service coffee cafes. This phenomenon sparked my curiosity and I set out to find out the driving force behind my morning cup of coffee.

Enhancing Product Portfolio with Gourmet Coffees

The Japanese coffee/tea shop sector can be divided into two main segments, namely “new style” self-service coffee/tea shop and traditional full-service coffee/tea shop. The market is currently experiencing a downward trend in total sales, where traditional full-service coffee/tea shops have reported decreases in both sales and outlets from ¥1,049.5 billion and 72,000 outlets in 2007 to an estimated ¥958.5 billion and 66,950 outlets in 2012. Despite this downward market trend, “new style” self-service coffee/tea shops are experiencing growth, from 3,860 outlets and sales of ¥249.9 billion in 2007 to an estimated 4,270 outlets and sales of ¥320.3 billion in 2012. Interestingly, the largest consumer segment for self-service coffee is women aged 30 to 50 who preferred drip coffee to canned coffee.

Sensing the market opportunity for self-service cafes, convenience stores, such as Seven-Eleven, Lawson, and Family Mart, have added self-service gourmet coffees to their product portfolios. Although this action brings convenience stores into direct competition with traditional full-service coffee shops, such as Starbucks and Doutor, convenience store self-service cafes possess two unique competitive advantages:

– Ability to offer freshly brewed coffee round-the-clock.

– Leverage on the vast locale of convenience stores to maximize its consumer reach, where every resident of Tokyo lives an average of just 4.5 minutes walk from the nearest convenience store.

Rising Demand for Self-Service Solutions

The rising demand for self-service cafes in Japan coincides with a growing demand for self-service solutions in North America which is estimated at $5.8 billion. Self-service kiosk transactions in North America are estimated at $775 billion in 2010 which is expected to grow past $1.0 trillion per year by 2014. Based on a global survey conducted by Steven Van Belleghem, data supplier SSI, and translation agency “No Problem” in April 2013, it suggests that as service expectations continue to rise, self-service solutions may be the only answer to meet consumer demands.

Based on a 2009 survey by the Self Service Kiosk Association, the success of self-service kiosks can be attributed to speed, convenience, and a liking for the technology. These results are consistent with the findings of Steven Van Belleghem, where 90% participants cited speed as the most important aspect of customer service.

These survey findings have far reaching implications on a company’s service strategy. The capture, analysis, and usage of data across sales activities becomes more important than ever in a changing sales paradigm where 40% participants preferred self-service to human contact for their future contacts with companies, and 70% participants expects a company website to include a self-service application. More importantly, 62% participants want faster and improved purchase possibilities through the user of client data, and 81% participants are willing to grant access to data to help cut waiting times. There is a need for companies to re-think their strategies for self-service solutions to not only improve efficiency, but also to improve customer relationships and satisfaction levels that will ultimately contribute to overall profitability. Companies that have successfully capitalized on this new paradigm include Amazon, AirBnB, and Booking.com.

All this talk of self-service kiosks, customer service strategies, and coffee is making me thirsty again. I think I will visit the nearest convenience store to get a cup of self-service coffee, pay my bills at the automated teller, and print my latest holiday pictures at the self-service digital printer.

What do you think of the future of self-service solutions and its impact on customer service strategies? Do share with us your thoughts and experiences!